Since mid-March, the spot price of rebar in Shanghai has dropped by 340 yuan/ton. The demand for steel in the peak season is lower than expected, the dual focus is weak, costs have collapsed, and a negative feedback for steel has formed. In order to stabilize prices and complete the industry's self-rescue, it is imperative for steel mills to reduce production.

1. The possibility of policy-based production cuts

There are two main ways to reduce production, one is policy production reduction, and the other is market independent adjustment. Recently, there are multiple versions of rumors about national crude steel production reduction in 2023, mainly "energy consumption will be the same as in 2022", "output will be the same as in 2021", "crude steel output will be the same as in 2022" and so on. However, the author believes that the probability of policies inhibiting crude steel production is small.

Policies are generally introduced to serve larger strategic goals and solve the main contradictions at the time, such as "three come, one reduce and one supplement", "carbon neutrality, carbon peak", etc. But from the current point of view, the core of domestic policies is to stabilize economic growth, and all policies must be oriented to serve economic growth. The reduction of crude steel is a tightening policy that is not in line with the current policy direction. Moreover, the downward cycle of domestic steel demand has begun. Only by market-oriented independent adjustment can we achieve the goal of removing crude steel. Administrative measures are needed to reduce the crude steel reduction rate.

2. Difficulty of market-based production reduction

The path of this round of production cuts mainly relies on independent market adjustment. Steel prices have been falling for nearly a month, but iron production has continued to rise, reaching 2.45 million tons as of April 7. Like many large manufacturing industries, steel output is difficult to adjust downward. Large-scale equipment requires steel companies to have higher requirements for the continuity of production, while heavy assets and high depreciation make industry profits more sensitive to production scale. When the scale is larger, the unit cost will be lower. When profits are poor but will not fall into serious losses, it is a rational choice to continue to increase production. According to statistics, the average depreciation per ton of steel for listed companies in the steel industry in 2019 was approximately 186 yuan/ton.

Industry attributes determine the difficulty of adjusting output, and the adjustment of output is slower than changes in demand. This is the fundamental reason for the mismatch between supply and demand and the fundamental reason for the cyclical fluctuations in steel prices.

3. Crude steel equilibrium output forecast

Data from the Bureau of Statistics show that domestic crude steel production from January to February was 168.96 million tons, a year-on-year increase of 6.8%. The iron output of 247 blast furnaces climbed to 2.45 million tons, which was at a relatively high level during the same period. Production reduction is inevitable, and how much production reduction can achieve a balance between supply and demand is a more important issue. The essence of production is demand, and changes in production are mainly regulated by demand. From this, crude steel production reduction can be calculated according to the logical idea of "demand determines production and production determines production reduction".

In 2023, policies to stabilize growth will be implemented frequently, real estate will recover weakly, and demand for crude steel is expected to increase by 0.5%-1% year-on-year. Assuming 0.5%, the demand for crude steel this year is 966.4 million tons. Steel exports are 64 million tons, the average of the past five years. Steel billet and steel imports have increased slightly year-on-year. The final forecast remains unchanged. The balance between supply and demand remains unchanged, and crude steel output 1,012.9 million tons, basically the same as last year. This shows that the flat regulation of crude steel is the most reasonable. Just compare the year-on-year changes in crude steel to observe the balance between supply and demand. For example, from January to February, domestic crude steel production increased by 10.74 million tons year-on-year, requiring a production reduction of 100,000 tons.

4. Industry changes after market-oriented production cuts

The impact of market-based production cuts on prices is generally divided into two stages. The early production cuts mean a decrease in raw material consumption, which will accelerate the collapse of steel costs, thereby inducing a negative feedback and steel prices falling rapidly and violently. Reducing production to the mid-to-late stage means that steel supply will soon rematch demand, which is expected to drive futures to stop falling before spot prices. Steel mills have not yet entered the production reduction stage and are in the brewing period, which means that steel prices still have room to fall.

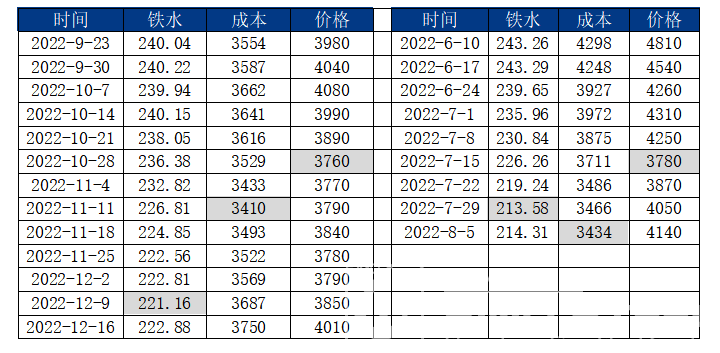

The adjustment of output is slower than the change of demand, which is the fundamental reason for the mismatch between supply and demand and the fundamental reason for the cyclical fluctuations of steel prices. In the foreseeable future, as steel mills continue to reduce production, steel supply will decline again, paving the way for a new round of price increases. Mid-July is the peak of the rainy season and the lowest point of demand, which is also a negative period. With the peak demand in September and October expected to approach and the demand in the real estate industry recovering significantly in the second half of the year, the steel market will face a new mismatch between supply and demand, and steel prices will start a new period. A rise.